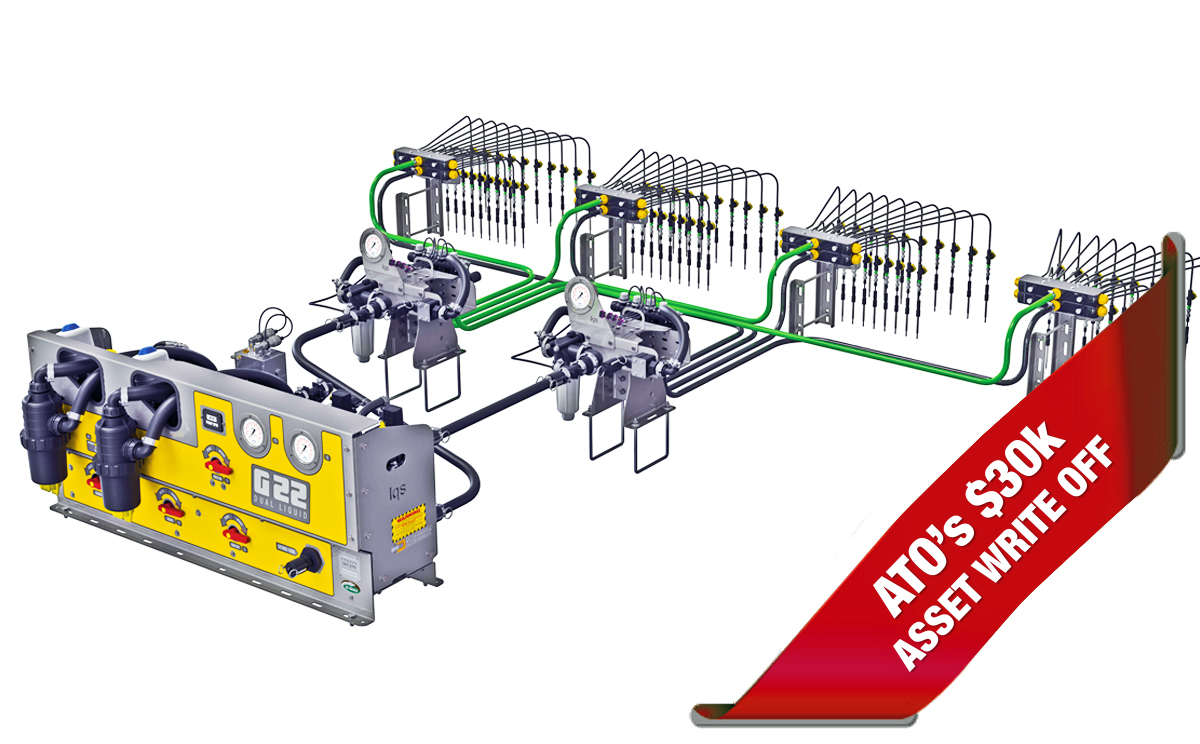

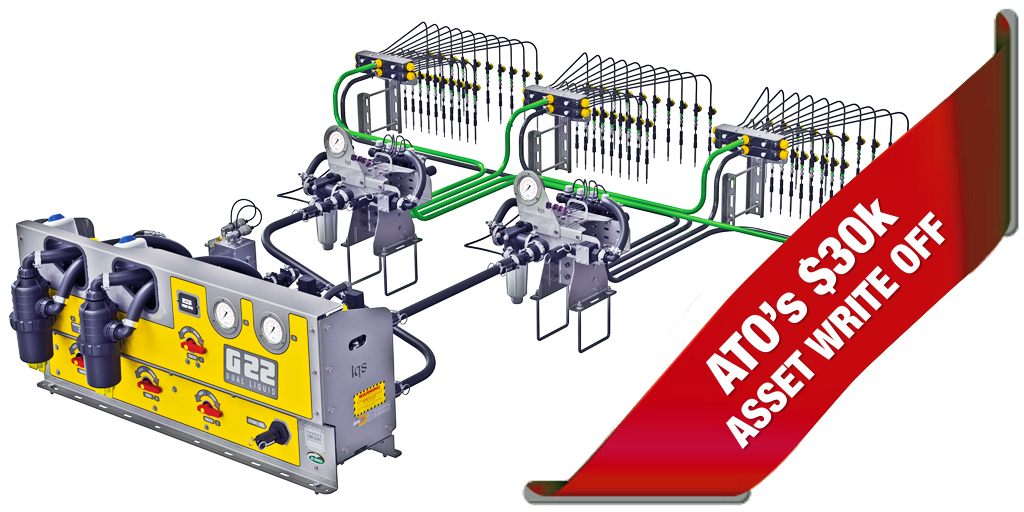

ATO’S INSTANT ASSET WRITE-extended to 2020

The instant asset write-off now also includes businesses with a turnover from $10 million to less than $50 million. These businesses can claim a deduction of up to $30,000 for the business portion of each asset (new or second hand), purchased and first used or installed ready for use from 7.30pm (AEDT) on 2 April 2019 until 30 June 2020.

THE ATO’S INSTANT ASSET WRITE-OFF HAS BEEN INCREASED AND EXTENDED.

The threshold has increased to $30,000, and has been extended to 30 June 2020.

CLIK HERE TO GO TO THE ATO’S LINK